Planned Giving

You may be looking for a way to make a significant gift to help further our mission. A bequest is a gift made through your will or trust. It is one of the most popular and flexible ways that you can support our cause.

A beneficiary designation gift is a simple and affordable way to make a gift to support our cause. You can designate our organization as a beneficiary of a retirement, investment, or bank account or your life insurance policy.

If you are 70½ or older, you may also be interested in a way to lower the income and taxes from your IRA withdrawals. An IRA charitable rollover can help you continue our work and benefit this year.

Charitable Bequest

A charitable bequest is one of the easiest and most flexible ways that you can leave a gift to Cristo Rey San Diego High School that will make a lasting impact.

Flowchart: Donor leaves property through will or trust to family and CRSD

Benefits of a Bequest

- Receive an estate tax charitable deduction

- Reduce the burden of taxes on your family

- Leave a lasting legacy to charity

How a Bequest Works

A bequest is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends, or Cristo Rey San Diego High School as part of your estate plan, or you can make a bequest using a beneficiary designation form.

Here are Some of the Ways to Leave a Bequest to Cristo Rey San Diego High School

- Include a bequest to Cristo Rey San Diego High School in your will or revocable trust

- Designate Cristo Rey San Diego High School as a full, partial or contingent beneficiary of your retirement account (IRA, 401(k), 403(b) or pension)

- Name Cristo Rey San Diego High School as a beneficiary of your life insurance policy

A Bequest May be Made in Several Ways

- Percentage bequest – make a gift of a percentage of your estate

- Specific bequest – make a gift of a specific dollar amount or a specific asset

- Residual bequest – make a gift from the balance or residue of your estate

Contact us

If you have any questions about leaving a bequest to us, please contact José Felix, Director of Advancement, at jfelix@cristoreysandiego.org, or call 619-432-1899. We would be happy to assist you and answer any questions you might have. If you have been so generous as to include a bequest to Cristo Rey San Diego High School as part of your estate plan, please take the time to let us know. We would like to recognize you and your family for your generosity.

Additional Information

The method used to make a bequest will depend on the kind of gift you choose to leave to Cristo Rey San Diego High School.

Bequests of real estate, personal property, business interests, and cash are typically made by way of a will, revocable trust, or even a simple codicil to your current estate plan. Your estate-planning attorney can assist you in preparing the necessary papers for you to complete the bequest.

Other bequests, such as those involving retirement assets, insurance policies, bank accounts, and stocks and bonds, are typically made by completing the appropriate beneficiary designation form. Simply contact your retirement plan administrator, life insurance company, bank or investment broker and ask them to send you the appropriate “beneficiary designation” or “payable on death” form. To complete your bequest, you will need to complete and sign the form and then send it back to the person who originally sent the form to you.

The last step in leaving any bequest involves the transfer to charity. When you pass away, the bequest property will be transferred to Cristo Rey San Diego High School. The full value of this gift will be transferred tax-free and your estate will receive an estate tax charitable deduction.

Beneficiary Designation Gifts

A charitable bequest is one of the easiest and most flexible ways that you can leave a gift to Cristo Rey San Diego High School that will make a lasting impact.

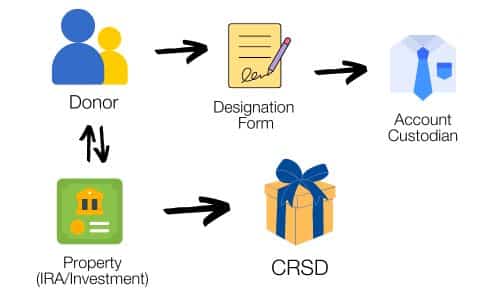

Flowchart: Donor executes designation form with account custodian to designate CRSD as beneficiary of a retirement, investment or bank account.

Benefits of a Beneficiary Designation Gift

- Support the causes that you care about

- Continue to use your account as long as you need to

- Simplify your planning and avoid expensive legal fees

- Reduce the burden of taxes on your family

- Receive an estate tax charitable deduction

How a Beneficiary Designation Gift Works

To make your gift,

- Contact the person who helps you with your account or insurance policy, such as your broker, banker or insurance agent.

- Ask them to send you a new beneficiary designation form.

- Complete the form, sign it, and mail it back to your broker, banker or agent.

- When you pass away, your account or insurance policy will be paid or transferred to Cristo Rey San Diego High School, consistent with the beneficiary designation.

Important Considerations for Your Future

If you are interested in making a gift but are also concerned about your future needs, keep in mind that beneficiary designation gifts are among the most flexible of all charitable gifts. Even after you complete the beneficiary designation form, you can take distributions or withdrawals from your retirement, investment or bank account and continue to freely use your account. You can also change your mind anytime in the future for any reason, including if you have a loved one who needs your financial help.

Contact us

If you have any questions about leaving a beneficiary designation gift to us, please contact us. We would be happy to assist you.

If you have already designated us as a beneficiary of an asset or as part of your estate plan, please contact José Felix, Director of Advancement, at jfelix@cristoreysandiego.org or by calling (619) 432-1899. We would be happy to assist you and answer any questions you might have.

Additional Information

Flexibility—Most beneficiary designation forms are very flexible. You can name Cristo Rey San Diego High School as a “full” or “partial” beneficiary of your account or life insurance policy. You can also name Cristo Rey San Diego High School as a “primary” or “contingent” beneficiary.

Family Considerations—Beneficiary designation gifts allow you to provide for family and support the causes that matter most to you. With a designation form you could, for example, name your spouse as the “primary” beneficiary and each of your children and Cristo Rey San Diego High School as “partial contingent” beneficiaries. With this arrangement, if your spouse survives you, he or she would receive the account. If not, the account or policy would be paid out to your children and Cristo Rey San Diego High School in whatever shares (or percentages) that you chose on the designation form.

Terminology—Beneficiary designation gifts are simple and straightforward. Common terminology includes “beneficiary designation” but also includes “payable on death” or “transfer on death.” The term “beneficiary designation” is most commonly used when naming beneficiaries of retirement plans or life insurance policies. The term payable on death (or “POD”) typically involves the designation of a beneficiary of a checking account, savings account or certificates of deposit, and transfer on death (or “TOD”) often involves the designation of a beneficiary of stocks, bonds or mutual funds.

Beneficiary Designations and Real Estate—Some states even allow “beneficiary designation deeds” or “transfer on death deeds,” which would allow you to name Cristo Rey San Diego High School as the survivor beneficiary of your home, farm or other real estate. As with other beneficiary designation gifts, these gifts are revocable by filing a revocation or new beneficiary designation deed.

IRA Charitable Rollover

You may be looking for a way to make a big difference to help further our mission. If you are 70½ or older, an IRA charitable rollover is a way you can help continue our work and benefit this year.

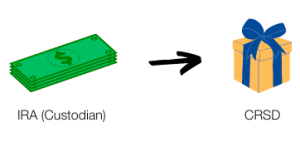

Flowchart: Donor directs IRA custodian to make an IRA charitable rollover gift to Cristo Rey San Diego (CRSD).

Benefits of an IRA Charitable Rollover

- Avoid taxes on transfers of up to $105,000 from your IRA to our organization

- Satisfy your required minimum distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the deduction limits on charitable gifts

- Help further the work and mission of our organization

How an IRA Charitable Rollover Gift Works

Contact your IRA plan administrator to make a gift from your IRA to us.

Your IRA funds will be directly transferred to our organization to help continue our important work. Please note that IRA charitable rollover gifts do not qualify for a charitable deduction.

Please contact us if you wish for your gift to be used for a specific purpose.

Contact us

If you have any questions about an IRA charitable rollover gift, please contact José Felix, Director of Advancement, at jfelix@cristoreysandiego.org or by calling 619-432-1899. We would be happy to assist you and answer any questions you might have.